On 21 September 2020, the Ministry of Finance has announced a tax incentive to promote investment, improve industrial capacity, enhance global competitiveness, and encourage relocation of a production facility. The incentive is on a tax exemption measure allowing 100% additional tax deduction for the purchase of (1) machinery; and (2) software for its automation system. All corporate entities, regardless of their legal forms and types of businesses carried out, are eligible to apply for the tax incentive under the criteria and conditions prescribed under the Royal Decree No. 710 and the relevant notification of the Director-General of the Revenue Department.

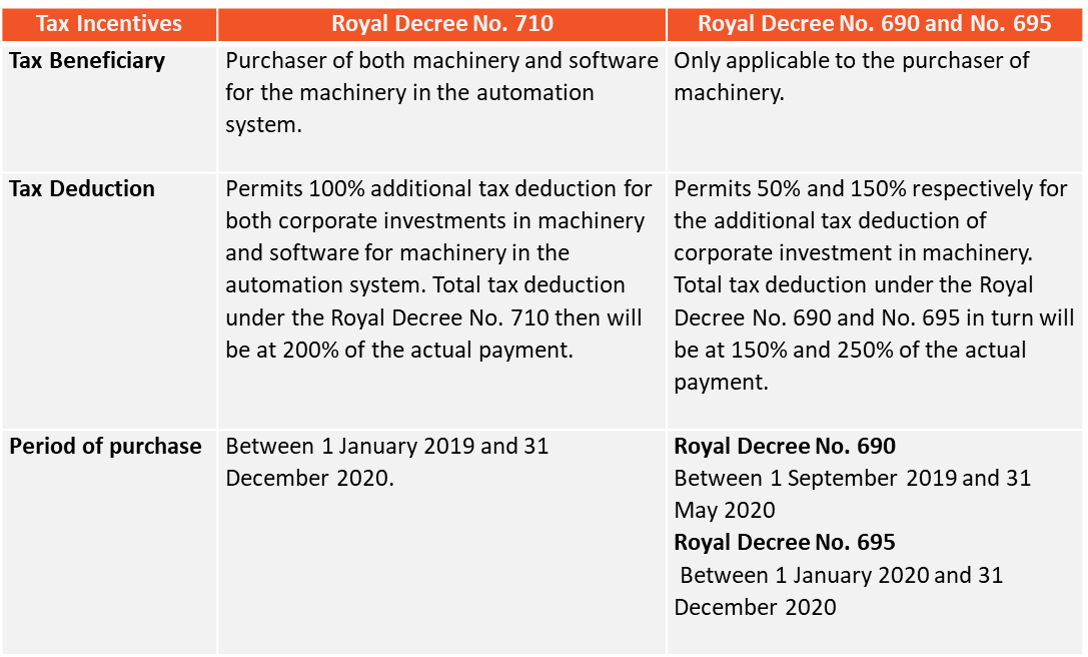

In the early months of 2020, the Ministry of Finance has also announced two royal decrees prior to the Royal Decree No. 710, which address similar tax incentive in relation to allowing the additional tax deduction for the purchase of machinery, namely the 1) Royal Decree No. 690; and 2) Royal Decree No. 695. The major distinctions can be identified below:

It is important to note that the tax benefit under Royal Decree No. 710 does not apply to machinery that has been entitled to tax benefit under other laws including Royal Decree No. 690, Royal Decree No. 695, or other royal decree or laws that have been issued previously.

The amount of additional tax deduction permitted under Royal Decree No. 710 is based on the actual price paid to acquire new assets between 1 January 2019 and 31 December 2020. Repair and maintenance expenses incurred to the existing assets do not qualify for this particular tax incentive program. Other conditions relating to additional tax deduction are subject to rules and procedures to be prescribed by the Director-General of the Revenue Department. Although the Director-General has not yet issued the criteria and conditions, assumptions can be made based on the notifications in relation to the Royal Decree No. 690 and No. 695 that the additional tax deduction shall be equally allocated across 5 taxable years.

To be eligible for the tax incentive, the machinery and software for the machinery in the automation system are subject to the following conditions:

-

- Must be used in the automation system investment project;

- Must have never been used before;

- Must be eligible for depreciation and amortization under Section 65 Bis (2) of the Revenue Code, and shall be acquired and ready for use by 31 December 2020;

- Must be located in Thailand;

- Must not be subject to tax benefit under other Royal Decree or laws, either in whole or in part; and

- Must not be used in a business that is subject to corporate income tax exemption under (1) laws of Investment Promotion; (2) laws of Competitiveness Enhancement for Target Industries; and (3) laws of Eastern Special Development Zone, either in whole or in part.

Corporate entity wishing to obtain this tax deduction incentive must submit details of the investment project together with the payment plan, and notify the Director-General, in accordance with the rules, procedures, and conditions to be prescribed by the Director-General. As of the date of publication of this legal alert, the Director-General has yet to issue the required notification. However, the corporate entity should study the criteria and conditions prescribed in the Director-General’s Notifications issued pursuant to the Royal Decree No. 690 and No. 695 in preparation to apply for the tax incentive.

It is good to note that a corporate entity that has tax losses is also entitled to apply for the tax incentive under the Royal Decree No. 710. The rule on loss carried forward as tax deduction for 5 years still applies.

For more information, please contact the authors or alternatively, you can reach out to our Tax Practice Group.

About Us

Tax Practice Group

Businesses often need proper tax planning and an efficient structure to sustain and enjoy long-term success. Our main goal is to provide a “one-stop service” where we can seamlessly connect with other practice to provide the most appropriate advice to our clients.

We have extensive experience in tax issues related to M&A, restructuring and wealth management especially when clients are faced with new business models, IPOs, as well as buying or selling assets to ensure tax mitigation and optimization. We conduct due diligence to determine whether or not tax planning is possible or required. This involves sharing specific tax privileges that our clients may or may not know they qualify for.

Our clients extends to a wide spectrum of segments; corporations, family businesses, and high net worth individual / ultra high net worth individual, who we believe requires attentive services and a responsive team, a value we strive and are known for.

Authors:

Saravut Krailadsiri

Partner

saravut.k@kap.co.th

Pichaya Nimcharoen

Associate

pichaya.n@kap.co.th