Following the latest creditors’ meetings on May 12 and May 19, 2021, Kudun and Partners is pleased to announce that Thai Airways Public Company Limited (THAI)’s business rehabilitation plan and its amendment proposal has been widely accepted by the majority of THAI’s creditors. The selected amendment proposal was submitted by the Federation of Savings and Credit Cooperatives of Thailand (FSCT), and was drafted and prepared by all the key creditors of the savings cooperatives group guided by Kudun and Partners’ litigation and restructuring team.

Kudun and Partners was also successful in assisting FSCT and other savings cooperatives secure three out of the seven seats on the board of creditors’ committee, which will play a crucial role in monitoring how THAI’s business rehabilitation plan is implemented by the plan administrators.

The three of them selected to be on the board of the creditors’ committee include Pol Lt Gen Viroj Satayasanaakul, President of the FSCT, Chartchai Rojanaratanangkule, Vice President and President of Financial Management Committee, EGAT Saving and Credit Cooperative Limited and Pracha Koonnathamdee, Assistant Professor of Thammasat University and Consultant of the Thammasat University Savings Cooperative. They shared their positive feedback on working with the team at Kudun and Partners.

Pol Lt Gen Viroj Satayasanaakul said, “We have received excellent legal services from Kudun and Partners (“KAP”) led by Khun Somboon Sangrungjang. Their team acted as a one-stop legal service center to all of the 87 Savings Cooperatives, which include guiding us on revising the rehabilitation plan, voting on the rehabilitation plan and board of the creditors’ committee, and providing us strategic legal advice. We are impressed with the highly effective legal services provided by the team because, with their help, we were able to accomplish our goals.”

“We consider this a major accomplishment for all savings cooperatives as we will now have three representatives monitoring the progress of the rehabilitation plan, ensuring our interests are protected. We made the right decision in appointing Kudun and Partners and wish to thank, in particular, Khun Somboon Sangrungjang for guiding us and providing us with strategic and pragmatic advice throughout the rehabilitation proceedings,” added Pracha Koonnathamdee.

Chartchai Rojanaratanangkule noted, “We are satisfied with the legal services provided by Kudun and Partners (“KAP”) and Khun Somboon. We realized it is incredibly difficult to coordinate 87 Saving Cooperatives to collectively decide on any matters and to proceed according to the plan in the same direction but KAP did it. KAP takes good care of all saving cooperatives at all times i.e. providing information, updating news and providing sound guidelines on the plan in every situation, even though the situation changes all the time. Furthermore, representatives of three saving cooperatives were elected and obtained high approval scores from all creditors because of KAP’s guidance. We agree that KAP has indeed helped all saving cooperatives succeed as we had expected.”

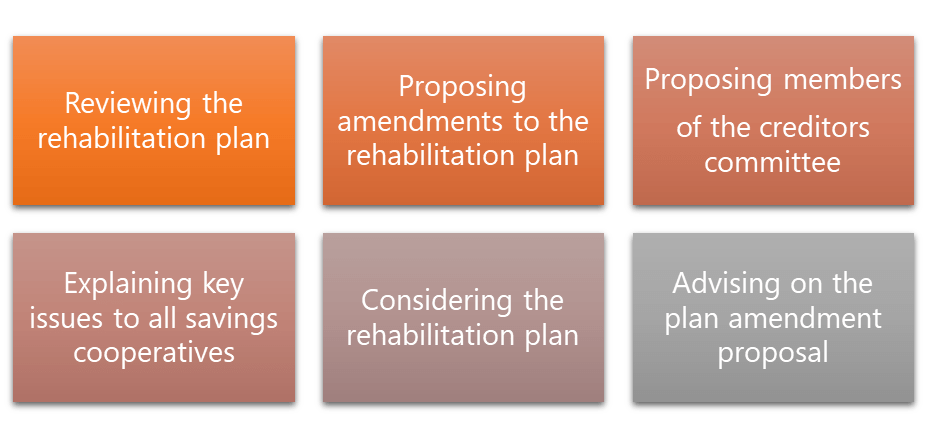

Kudun & Partners was officially appointed in August 2020 to represent FSCT and 87 savings cooperatives in THAI’s business rehabilitation, regarded as Thailand’s largest business rehabilitation proceeding ever, with initial estimated total debts of THB 352.49 billion (approximately USD 11.34 billion). The firm’s first major involvement was back in October 2020 when we assisted FSCT and 87 savings cooperatives, the group of creditors that holds the largest debenture debts, in submitting their debt repayment applications as well as providing legal advice and addressing various issues that arose during the application. Throughout the business rehabilitation, Kudun and Partners has been working closely with key creditors of the savings cooperatives group, including FSCT, the Electricity Generating Authority of Thailand (EGAT)’s Savings Cooperative, Provincial Electricity Authority (PEA)’s Employees Savings and Credit Cooperative Limited, Chulalongkorn University Savings Cooperative Limited, Thammasat University Savings and Credit Cooperative Limited, and Kasetsart University Savings and Credit Cooperative Limited. Our role has involved the following:

Our role has involved the following:

All the works were carried out in order to secure the best possible outcome for all savings cooperatives in THAI’s business rehabilitation.

In the next phase, the Central Bankruptcy Court will hold a hearing on May 28, 2021, to consider whether or not to approve THAI’s business rehabilitation plan. Once the court gives its approval, THAI will have five years to implement its business rehabilitation plan.

The case is led by our partner and co-head of dispute resolution and litigation practice, Somboon Sangrungjang together with partners, Kudun Sukhumanada and Niruch Winiyakul and associates Navawan Tipsrinimit and Wadtawan Wongrathpanya.

Pol Lt Gen Viroj Satayasanaakul said, “We have received excellent legal services from Kudun and Partners (“KAP”) led by Khun Somboon Sangrungjang. Their team acted as a one-stop legal service center to all of the 87 Savings Cooperatives, which include guiding us on revising the rehabilitation plan, voting on the rehabilitation plan and board of the creditors’ committee, and providing us strategic legal advice. We are impressed with the highly effective legal services provided by the team because, with their help, we were able to accomplish our goals.”

Pol Lt Gen Viroj Satayasanaakul said, “We have received excellent legal services from Kudun and Partners (“KAP”) led by Khun Somboon Sangrungjang. Their team acted as a one-stop legal service center to all of the 87 Savings Cooperatives, which include guiding us on revising the rehabilitation plan, voting on the rehabilitation plan and board of the creditors’ committee, and providing us strategic legal advice. We are impressed with the highly effective legal services provided by the team because, with their help, we were able to accomplish our goals.” “We consider this a major accomplishment for all savings cooperatives as we will now have three representatives monitoring the progress of the rehabilitation plan, ensuring our interests are protected. We made the right decision in appointing Kudun and Partners and wish to thank, in particular, Khun Somboon Sangrungjang for guiding us and providing us with strategic and pragmatic advice throughout the rehabilitation proceedings,” added Pracha Koonnathamdee.

“We consider this a major accomplishment for all savings cooperatives as we will now have three representatives monitoring the progress of the rehabilitation plan, ensuring our interests are protected. We made the right decision in appointing Kudun and Partners and wish to thank, in particular, Khun Somboon Sangrungjang for guiding us and providing us with strategic and pragmatic advice throughout the rehabilitation proceedings,” added Pracha Koonnathamdee.