Since 2022, Thailand has been steadfast in its pursuit of the “30@30” policy, which aims to promote the electric vehicle industry in Thailand and achieve a 30% share of Zero-Emission Vehicles (“ZEV”) in overall vehicle production by 2030. This strategic initiative is intended to position Thailand as an important global hub for electric vehicles (“EV”) production. In line with this policy, the cabinet initiated the first phase of electric vehicle promotion measures, known as EV 3.0, in 2023. The primary objective of this phase is to stimulate the market and encourage people to switch and use battery electric vehicles (“BEV”) in Thailand through various means; such as subsidies, reduction of import duties, and excise tax incentives. The resounding success of EV 3.0 is evident, surpassing the sales target for BEVs and demonstrating a notable increase in consumer demand within a year.

On November 1, 2023, the cabinet approved and enacted the second phase of electric vehicle promotion measures, referred to as EV3.5 (“EV3.5 Measures”), to further propel the burgeoning BEV market in Thailand. Proposed by the National Electric Vehicle Policy Commission, this phase extends similar privileges to business operators, paving the way for further growth of BEV-related businesses in Thailand.

In order to implement the Cabinet solution concerning EV3.5 Measures, the Director General of the Excise Department has promulgated the Notification of the Excise Department in connection with the Determination of Criteria, Procedures, and Conditions for the grant of rights in accordance with the Measures for the Promotion of Electric Vehicles and Motorcycles Phase 2 (the “Notification”), which was officially issued on December 28, 2023, and has been in effect since January 1, 2024. The Notification outlines the specific criteria, procedures, and conditions governing the grant of rights under the EV3.5 Measures, delineating the particulars of the privileges as outlined below.

Eligible Applicants for Privileges Under the Notification

The Notification defines the categories of applicants entitled to receive privileges under its purview into seven distinct types as outlined below:

-

- The industrial operator;

- The industrial operator with an established industrial factory location within the Customs Free Zone under the Customs law;

- The industrial operator with an established industrial factory location within the Free Trade Zone under the Industrial Estate law;

- The importer who qualifies as an industrial operator as specified in clauses (1), (2), and (3);

- The importer appointed as an authorized dealer by the industrial operator mentioned in clause (2);

- The importer is appointed as an authorized dealer by the brand owner, having entered into a sub-contract for manufacturing agreement with the industrial operator in clause (2); and

- The importer engaged in a sub-contract for manufacturing agreement with a company that has been granted a promotion certificate for investment under a category of BEV manufacturing.

Categories of Vehicles and Associated Privileges

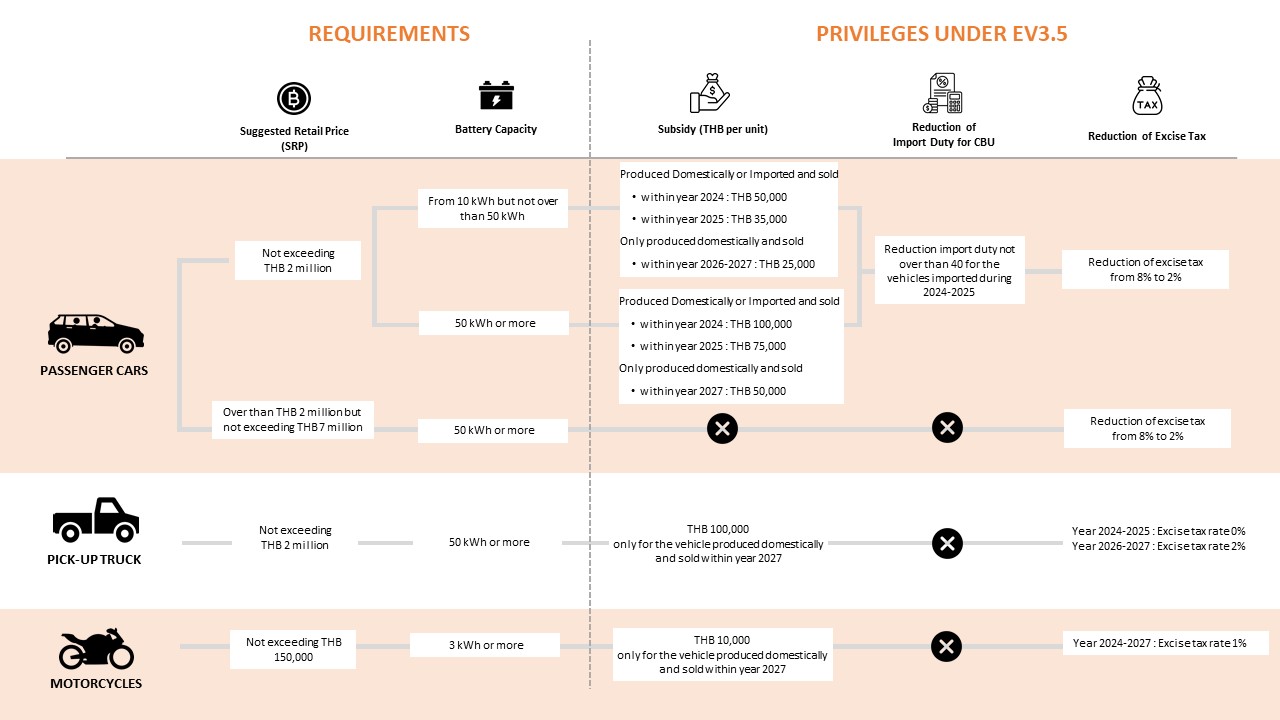

The Notification stipulates that subsidies and tax privileges are contingent upon the type of vehicle, considering factors such as suggested retail price and battery capacity. The details are presented in the diagram below.

Additional Conditions

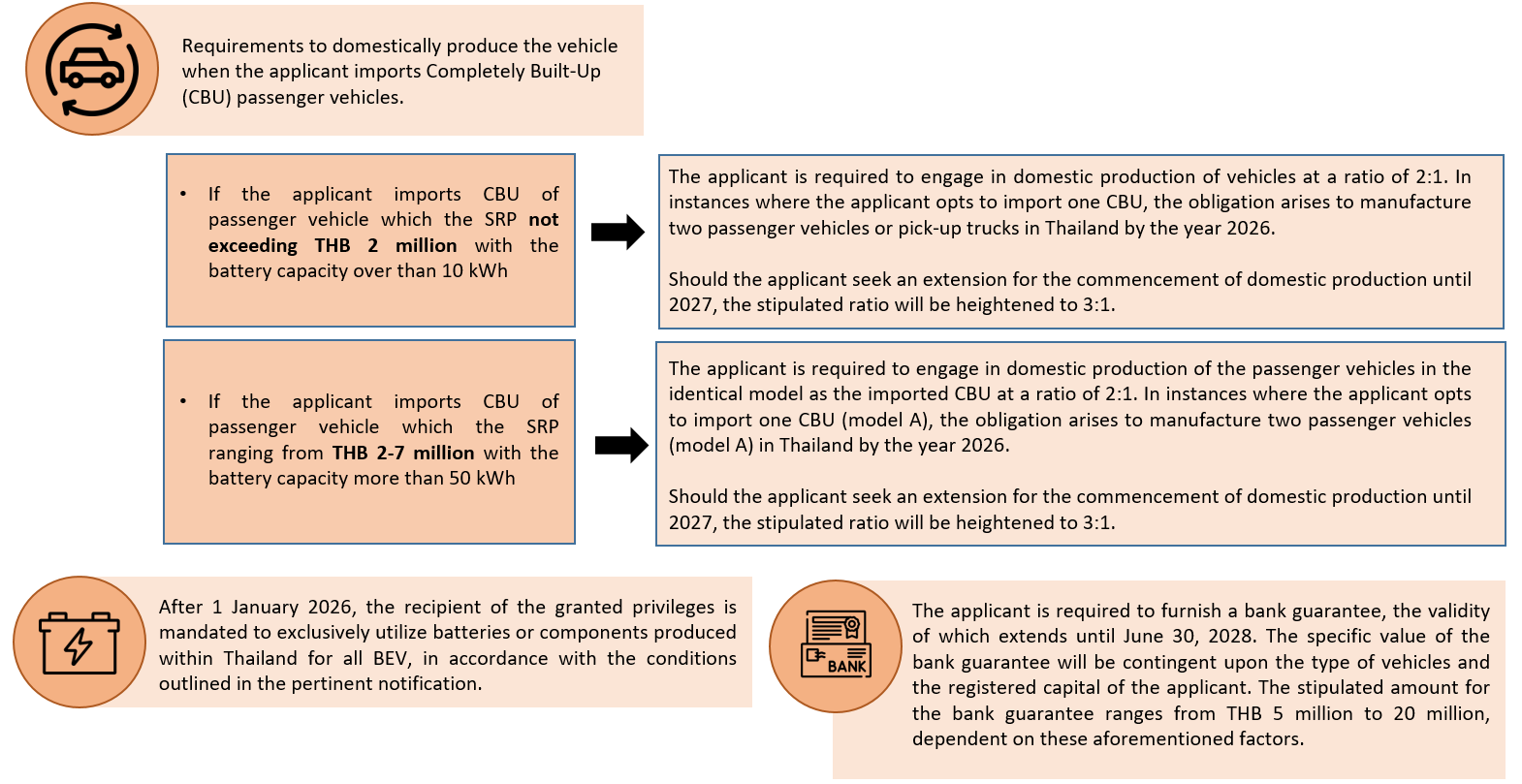

In addition to the overarching criteria concerning suggested retail price and battery capacity outlined in the diagram mentioned above, industrial operators seeking to avail themselves of privileges under EV3.5 Measures must carefully adhere to and satisfy the following conditions:

The Excise Department has initiated mutual agreements with selected BEV business operators to facilitate the provision of privileges under the EV3.5 Measures. This strategic move is anticipated to foster increased competitiveness within the vehicle industry, facilitating the transition from combustion engine vehicles to electric vehicles. The implementation aligns with the goal of reducing pollution and mitigating the greenhouse effect.

For those contemplating the utilization of privileges under the EV3.5 measures and seeking guidance on compliance with relevant requirements and regulations, the legal team at Kudun and Partners stands ready to provide comprehensive assistance. Our team ensures smooth navigation through the pertinent processes, guaranteeing the optimal commencement of your business endeavors.

Should you require further information regarding relevant regulations or any additional notifications pertaining to the automobile industry, please do not hesitate to contact the authors at thanyaluck.t@kap.co.th or our dedicated team at Kudun and Partners.

About us

Projects and Energy Practice Group

Kudun and Partners has a broad range of experience in all aspects of the energy industry including solar farms, solar rooftops, wind farms, Waste-to-energy (WtE) and natural gas power plants. We leverage our unparalleled business and legal prowess assisting clients from inception to completion of a project, throughout the project’s operational lifecycle. Our services include providing advice on FDI regulations, incentives by the BOI, company incorporation, corporate structure, tax structuring, acquisition and joint venture agreements, bid preparation, contract negotiation, and project financing.

Our award-winning work includes representing

B. Grimm Power and Energy China Consortium in the successful bid and development of the world’s largest hydro-floating solar hybrid power project at Sirindhorn dam by the Electricity Authority of Thailand (EGAT) worth over THB 842 million (approximately USD 27 million).