Thailand is at a powerful crossroads in its economic development. After several decades of consistent growth, it is now preparing to finally break through and become a high-income nation.

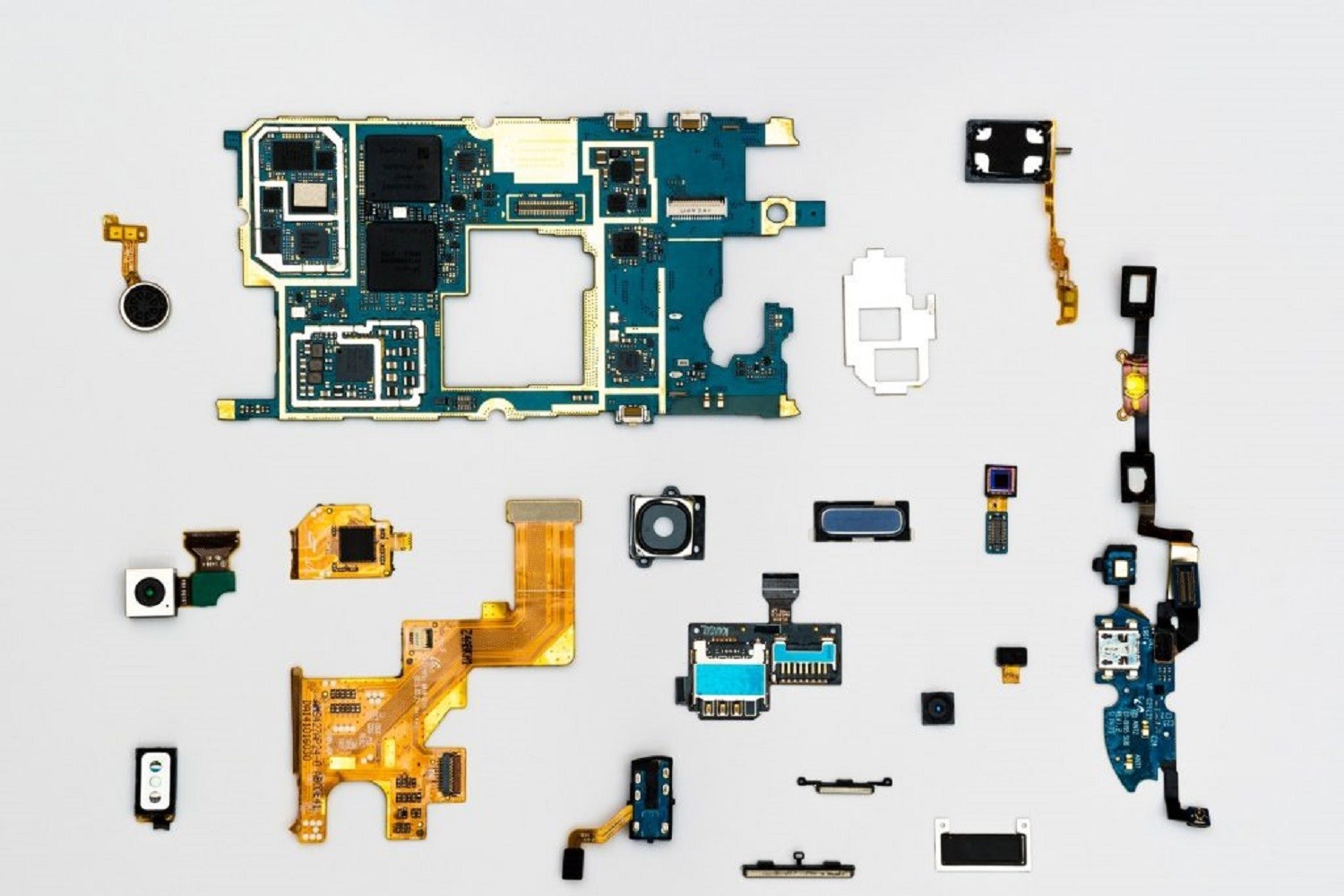

To do this, it is focusing on smart industry. A high-income Thailand is one driven by technological progress, so the government has begun pouring money into robotics and automation. These technologies are set to change the face of manufacturing, making processes faster, more intelligent and more efficient and hopefully attracting increasing levels of investment in the sector.

Kudun & Partners is a leading Thai law firm working with a number of domestic and foreign clients in the manufacturing sector. We’re currently witnessing unprecedented levels of transformation with regards to technology. Discover our insights into the future of robotics and automation in Thai manufacturing here.

Thailand 4.0

Robotics and automation is one of ten industries targeted for growth under Thailand 4.0, the Board of Investment’s (BOI) ambitious economic model designed to propel the country into high-income status. These sectors are known as the ‘S-Curve’ industries:

-

- Biochemical and biofuels

- Digital Economy

- Medical Hub

- Automation and Robotics

- Aviation and Logistics

- Agricultural and Biotechnology

- Smart Electronics

- Affluent Medical and Wellness Tourism

- Next-Generation Automotive

- Food for The Future

As well as being a targeted sector in its own right, robotics and automation underpins several of the other S-Curve industries, including next-generation automotive, smart electronics and aviation and logistics.

What does this look like in practice?

Thailand is a traditionally export-reliant economy, so the health of the manufacturing sector is always a priority. Modernising industrial processes through automation will make Thai products more attractive to overseas buyers and enable manufacturers to be more agile.

Investment incentives

In 2017, the Thai government announced a 200 billion baht robotics development plan designed to improve industrial productivity. Participating firms will benefit from a 50% reduction in corporate tax over a three-year period, a 300% deduction of corporate tax for research and development, import duty waivers for robotics and automation equipment and soft loans for SMEs looking to improve their operational processes through related systems.

Foreign investment has an important role to play in this development plan, as Thai manufacturers will require the expertise of global robotics giants. Companies including Germany’s KUKA Robotics—owned by China’s Midea Group—, Japan’s Nachi Technology and Switzerland’s ABB have all expanded their industrial operations in Thailand.

A new workforce

The Thai manufacturing workforce is also set to be transformed by the roll-out of robotics and automation, moving from a labour-intensive and production-focused skills base towards technical expertise and innovation.

The government wants to see the number of specialised systems integrators in Thailand to rise from 200 to 1,400 in just five years and is helping companies establish dedicated robotics centres in partnership with one of its eight selected educational institutions in order to meet this target. These experts will be tasked with achieving another government target: the development of at least 50 prototype robotics and automation systems.

If successful, this development plan will boost the Thai manufacturing sector’s adoption of robotics from 30% to 50% and reduce its annual import bill for such systems by 132 billion baht.

Conclusion

The Thai government has kicked down the doors for investment in industrial automation with its attractive incentives and commitment to developing a domestic skills base. If you would like to know more about investing in Thailand’s manufacturing sector or require legal advice on a specific transaction, please contact Kudun & Partners experienced and forward-thinking team today.