With digital technology improving and the pandemic recovery already underway, Thailand’s business world is experiencing a new wave of ambitious startups. In order to succeed in this highly competitive environment, startups require adequate funding from key investors, venture capitalists and angel investors. In such a crowded environment, however, raising money is no easy task. Attracting the attention of international investors can be difficult, while funding via IPO takes a considerable amount of time and requires jumping a number of legal hurdles. Fortunately, there are simpler options – and this is where alternative debt financing comes in.

One method which is gaining renewed attention is called convertible debt financing. This type of arrangement begins in the standard way: with the startup borrowing money from a lender. The innovative element of this financing model arises through the process of repaying the lender for its services. This repayment can take one of two forms:

1. Over time, as the startup reaches certain agreed-upon milestones, the loan is automatically converted into equity – typically, shares in the company. The net result of this conversion is that the lender acquires an ownership stake in the borrowing company, at a lower price than would be possible through traditional means, once the startup achieves its early growth goals

2. If the startup is unable to meet these goals by the time the loan matures, then the loan must be repaid in full to the lender.

Viewed in these terms, the appeal of convertible debt financing is immediately apparent. Lenders can gain significant equity for their investment, yet if company fails to reach its growth targets, their money is treated like a traditional loan, and they are repaid.

Startups likewise benefit from the ability to offer such a low-risk, high-reward option, as such an arrangement can help them stand out even in a crowded field. Much depends on startups’ success in attracting the attention of investors, and tools like convertible debt financing can be a great help in this effort. Moreover, the convertible debt financing approach lets startups receive funding even before they receive a valuation.

As we will see, however, this type of alternative debt financing has its drawbacks as well – both legal and practical. Only by looking at the complete picture can startups determine whether such financing methods represent the right path for them.

Convertible debt financing and Thai law

Previously in Thailand, under the Thai Civil and Commercial Code, private companies were not allowed to issue convertible debentures to investors. Yet the Securities and Exchange Commission, Thailand (“SEC”) realized it needed to make Thailand more competitive within the region, which meant boosting investment. Startups and SMEs may now offer convertible debentures via private placements under certain conditions. Although these conditions are stringent, the door is now open for alternative debt financing.

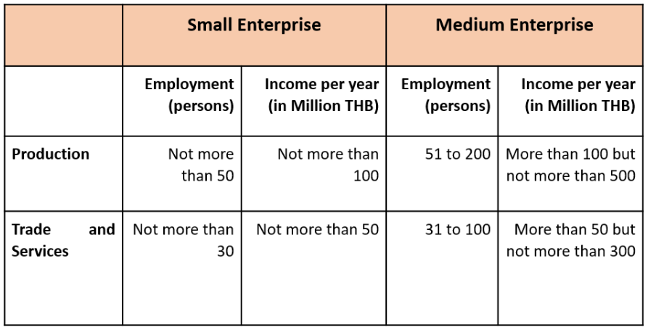

To qualify, SMEs must fit into one of the boxes below:

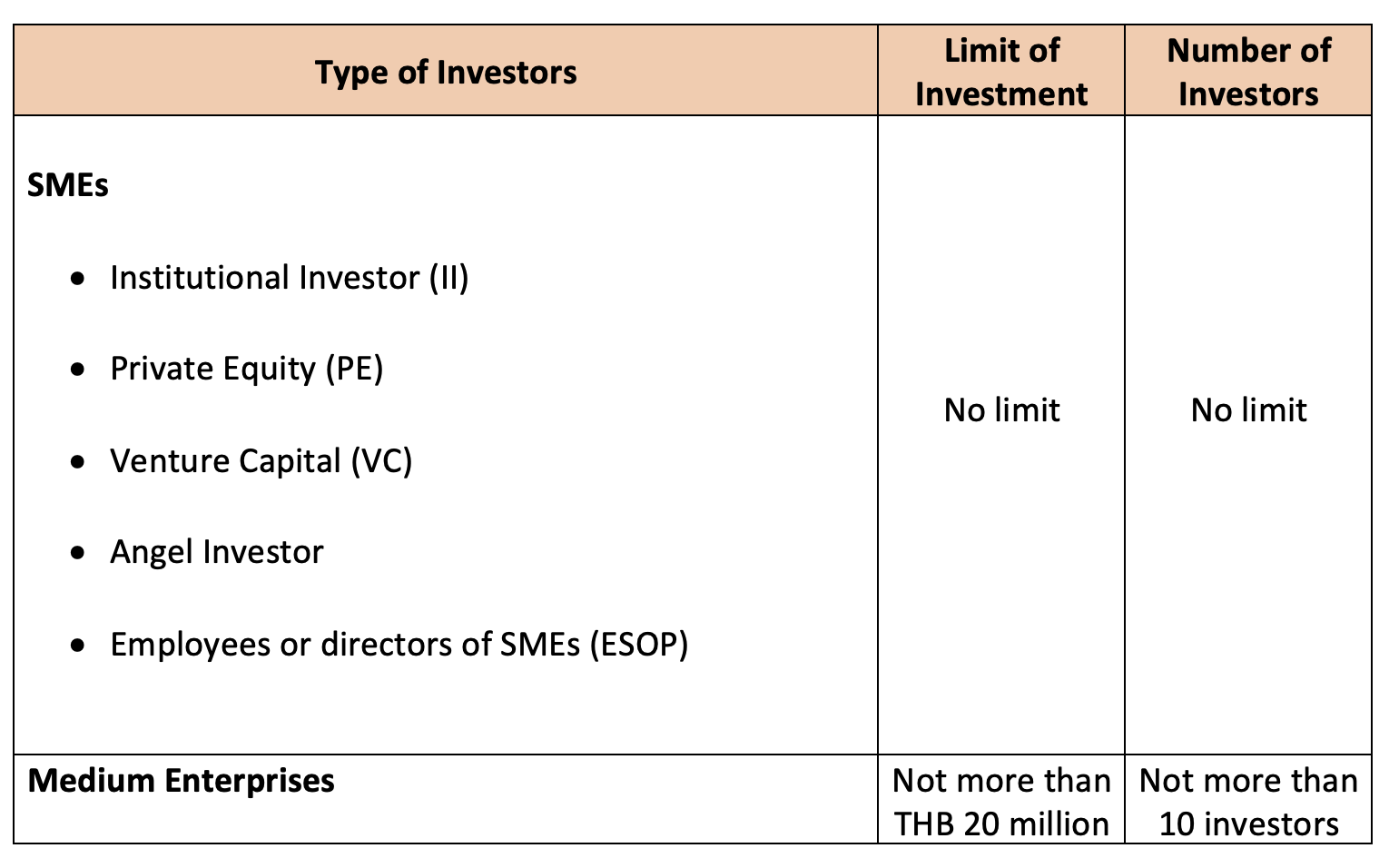

It is also important to note that only certain types of key investors have been approved by the SEC to participate in convertible debt financing. Moreover, in some cases, there are limits to how many investors are allowed to do so, and to how much total investment is permitted using this financing model. Details are in the infographic below:

Participating companies must also complete the paperwork associated with convertible debt financing in Thailand. This process includes registering for the Capital Market Fundraising Promotion Project for SME (PP-SME) with the Office of Small and Medium Enterprises Promotion (OSMEP). It also involves preparing an SME Factsheet, and submitting investment information to the Thai SEC within 15 days after the convertible debt financing offer has closed.

Other regulatory requirements also apply – such as the need for startups to restrict financing offers to pre-selected investors, rather than announcing them to the wider investment market – and startups must tread carefully to ensure compliance.

Pros and cons of alternative debt financing

Though ‘alternative’ by some standards, convertible debt financing is commonly used and accepted by investors around the world. Its benefits include lower transaction costs than those of other forms of investment, while also offering lenders a significant discount (usually 20%) on company equity. An interest rate remains in place as well, making this solution a relatively easy sell to investors.

Convertible debt financing also has its pitfalls, however, this type of loan tends to reach maturity in one or two years, giving the SME little time to lose in reaching the milestones it proposes. In addition, this method of financing sometimes creates organizational complications, as it can be difficult to keep an accurate record of every convertible note in cases where a large number of investors are participating. Lastly, of course, it is worth stressing that a successful financing round will leave the lender holding a percentage of the company. Depending on the SME’s prospects for future growth, this outcome may or may not be ideal.

The aforementioned challenges, in addition to the legal requirements attached to this form of financing, mean that SMEs should think (and prepare) carefully before choosing convertible debt financing as their fundraising approach.

On balance, convertible debt financing represents an important addition to Thai business law. This tool facilitates investment opportunities on favorable terms, which in turn helps SMEs attract more attention from key investors. Qualifying companies that anticipate near-future growth will find this financing method to be very much worth considering.

Legal and practical expertise for the road ahead

Given the availability of other fundraising options, such as crowdfunding, IPOs and equity financing, convertible debt financing has long been neglected in the world of Thai startups. The liberalization of alternative debt financing laws affords a new and very promising path forward for qualifying companies, however – if they adhere to regulations and implement the right strategy.

As startups and investors in Thailand begin to take notice of convertible debt financing opportunities, now is the time to leverage this investment tool for greatest competitive advantage. The Kudun and Partners Startup Team can help SMEs navigate the legal and practical hurdles that arise, so that your business can access the funding it needs in order to thrive in the months and years ahead.

About us

Kudun and Partners, Kingsford Securities PCL and 2EXT have teamed up in a dynamic collaboration providing a one-stop service focal point for startups and investors to connect and help achieve their goals through coaching, mentoring, consulting, business matching and taking risk with them.

With our expertise in the financial, legal, and startup business, we aim to offer startups an accessible yet professional consultancy service, which will benefit startups and the growth of the startup ecosystem in Thailand.